An article in The Washington Post titled, “Americans’ top five financial resolutions and how to make them stick” illustrates people’s WANT to budget and save. The author provides some good tips on how to make a budget and stick to it (the subheading – no you don’t need a budgeting app to control your spending is pretty good too).

This article does not account for large amounts of debt. Something in life happens where you are laid off, injured or just simply without the money to save. You use credit to survive and all of a sudden – you are stuck. Saving money becomes far more difficult when you are making minimum payments only to use your credit because your cash is gone.

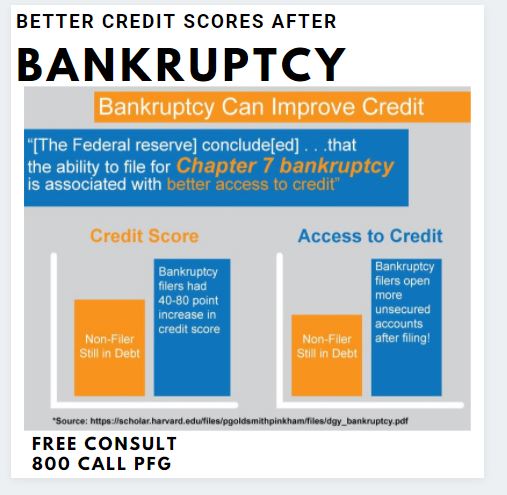

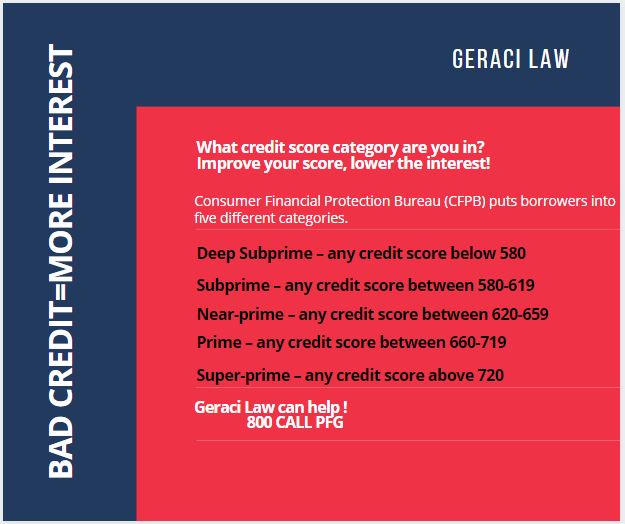

THAT is where Geraci Law can help. No one wants to file for bankruptcy but life happens and that’s what the Fresh Start Button is for. So many clients are happy and relieved and are ABLE to:

- Start a savings account. Think about it – if you are spending $600 per month on minimum payments, you eliminate the debt and you have THAT $600 extra per month. Put 1/2 away in a savings account and in a year – you are at $3,600 in emergency funds (put ALL into a savings account and you are at $7,200).

- Invest – see the article. The author references a free course from the North American Securities Administrators Association (NASAA).

You cannot start saving until you deal with the debt problem. Geraci Law attorneys are ready to talk to you and review all of your options. Read the article at https://www.washingtonpost.com/business/2022/01/04/new-years-advice-to-keep-financial-resolutions/

Dial 1-800-CALL-PFG for a free phone mini-consultation, or make an appointment online 24/7 at www.infotapes.com. Bankruptcy laws are in place to help you. Who knows bankruptcy like Geraci Law? Geraci Law has 30,000 5-star reviews ![]() since November 2016!

since November 2016!

Read ALL ABOUT DEBT RELIEF at www.bankruptcybookbypeterfrancisgeraci.com.