Bad Credit = MORE Interest

According to an article on CNBC (read here) – more than 1/3 Americans have a credit score that is considered “subprime.” If you are one of these people, you may end up paying THOUSANDS more in interest than borrowers with better credit scores. Filing a bankruptcy can HELP improve your credit score!

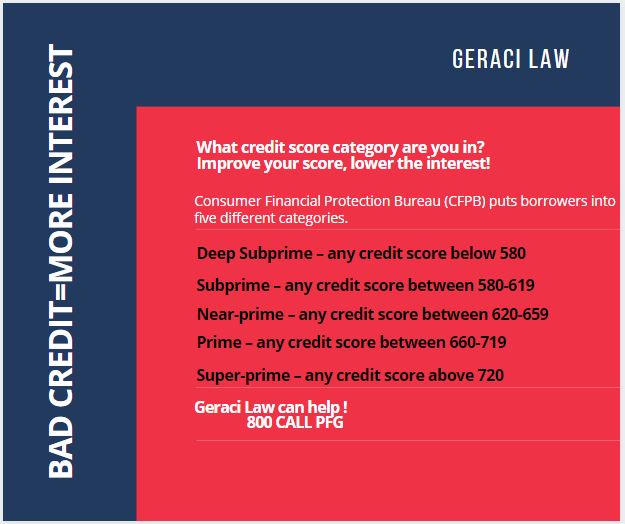

The Consumer Financial Protection Bureau (CFPB) puts Americans into five different categories.

Deep Subprime – any credit score below 580

Subprime – any credit score between 580-619

Near-prime – any credit score between 620-659

Prime – any credit score between 660-719

Super-prime – any credit score above 720

Where do you fall? Your credit score is not only determined by timely payments. Your debt to income ratio plays a role. Do you have more debt than income in a year? Are you behind on payments? Are you considering borrowing money from a 401K or family member to pay off debt? Before you make a huge decision, talk with a Geraci Law attorney (guess what – it’s FREE).

Even if you are paying your minimum payments, you may not realize how much you are paying in interest! According to the CFPB, a Deep Subprime borrower paid 21.50% interest versus a Super-Prime borrower paying 12.50%. That is a HUGE difference.

Filing a bankruptcy could change your life for the better. You may IMPROVE your financial future to qualify for the better rates on mortgages, car loans or even credit cards. Don’t know your credit score? Not sure of what debt is reporting? Geraci Law can help!

Want more information about credit scores and bankruptcy? Below are a couple of links to related topics!

FICO Creates New UltraFICO Scoring System

When Should I File For Bankruptcy?

Credit Concern? Call Geraci Law!

Dial 1-800-CALL-PFG for a free phone mini-consultation, or make an appointment online 24/7 at www.infotapes.com. Bankruptcy laws are in place to help you. Who knows bankruptcy like Geraci Law? Geraci Law has 30,000 5-star reviews ![]() since November 2016!

since November 2016!

Read ALL ABOUT DEBT RELIEF at www.bankruptcybookbypeterfrancisgeraci.com.