Rockford Residents – We’re Here for You!

Back in 2013, Chrysler shut down the legal department. Before, Chrysler employees had free legal representation including bankruptcy filings. Now, Chrysler employees in need of financial help are left to find their own counsel.

Geraci Law is here for you in our Rockford, Illinois office. No one understands how hard it’s been for employees from Chrysler in Belvidere. Since 2018, you’ve dealt with multiple shutdowns, overtime cuts and furloughs ranging from one week to entire month. Geraci Law staff gets it. We know you are trying, we know it’s tough.

Meet our Geraci Law staff in Rockford. We’ve helped tons of coworkers, friends and family. Geraci Law is local and we’re here for you. Call us at 800 CALL PFG.

Attorney Jason Nielson

Attorney Jason Nielson

Attorney Jason Nielson is a senior attorney at Geraci Law. He is licensed to practice in Illinois and Texas. Attorney Nielson started with Geraci Law in 2007. He is an expert in the Northern and Western districts of Illinois.

Clients say, “Pleased that everything went through in a timely manner! We were helped every step of the way, from filing Chapter 7 or Chapter 13. We were guided through each step, very helpful! Our minds were set at ease. Give a call to: Jason Nielson if you have questions about any Bankruptcy and Dept Legal Service you need. As with us, we are sure he will answer then guide you as to the best route for you! Thank you Jason.”

Attorney Phil Hart

Attorney Phil Hart

Attorney Hart used to work for Chrysler legal department, he now handles court work for Geraci Law. He’s an expert in Chapter 7 and Chapter 13 bankruptcy petitions.

Attorney Joseph D’Onofrio

Attorney Joseph D’Onofrio

Attorney Joseph D’Onofrio graduated with a Bachelor of Arts from Northern Illinois University. He went on for his Juris Doctorate at Valparaiso University Law School.

Clients say, “Filing bankruptcy is NOT something that I never thought that I should do HOWEVER circumstances changed and I thought it was the worst thing I could do to change my situation. However after going in to Geraci and talking to Mark I was put at ease and decided that it was the best thing I could do. Joe D’Onofrio continued to make this process quick and easy to understand and was of immense help to me. These folks are calming and so easy to talk to and I can’t thank them enough! They are awesome and continued communication has been awesome as well!”

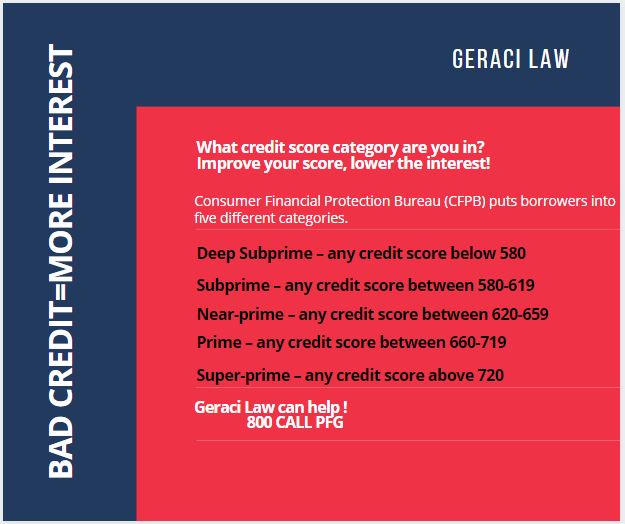

Dial 1-800-CALL-PFG for a free phone mini-consultation, or make an appointment online 24/7 at www.infotapes.com. Bankruptcy laws are in place to help you. Who knows bankruptcy like Geraci Law? Geraci Law has 30,000 5-star reviews ![]() since November 2016!

since November 2016!

Read ALL ABOUT DEBT RELIEF at www.bankruptcybookbypeterfrancisgeraci.com.