Geraci Law lawyers have been practicing bankruptcy for a combined total of 500 years, some as many as 25 or more than 40 years. Our advice is: “if you are running a business that is failing, do not file bankruptcy. Close the business, file your tax returns, and come and see us in two years”.

Read new article from Attorney Peter Francis Geraci titled, “Bankruptcy Filing will not Save a Going Business.” Read more articles at https://www.infotapes.com/articles/news/75/bankruptcy-filing-will-not-save-a-going-business/

Full article is below.

Small business bankruptcy or self-employed bankruptcy is usually a bad idea

By Peter Francis Geraci

Why Self- employed and small businesses DO NOT QUALIFY for bankruptcy relief.

Bankruptcy, whether it’s Chapter 7, 11 (whether a regular chapter 11 or the new subchapter 5), 13, does not solve the common problem of lack of money. Most self-employed people were small businesses have your regular income, and often can’t even meet payroll or regular living expenses. Businesses are doomed to fail. Bankruptcy will not solve that problem.

Geraci Law lawyers have been practicing bankruptcy for a combined total of 500 years, some as many as 25 or more than 40 years. Our advice is: “if you are running a business that is failing, do not file bankruptcy. Close the business, file your tax returns, and come and see us in two years”.

There are many good reasons:

if you have a corporation, or an LLC, and you’re not operating as a self-employed person, Corporation filing Chapter 7 results in the corporation getting by a bankruptcy trustee

corporations can’t file under Chapter 13. Corporations that file under Chapter 11 usually get converted to chapter 7 on that liquidated, the fees are very high, and it’s only for corporations that have positive cash flow, or can get new financing to continue operating. Its like trying to save the Titanic.

if you are a small business that is not incorporated or an LLC, it is usually a bad idea to file either chapter 7 or 13 total businesses been closed for at least two years

A small business that files Chapter 7 gets the business liquidated by a bankruptcy trustee. You can do that yourself, way cheaper. It is a much better idea to simply close it if you don’t want to operate it, pay all the taxes doing file all the necessary returns, wait two years and see if anybody is bothering you.

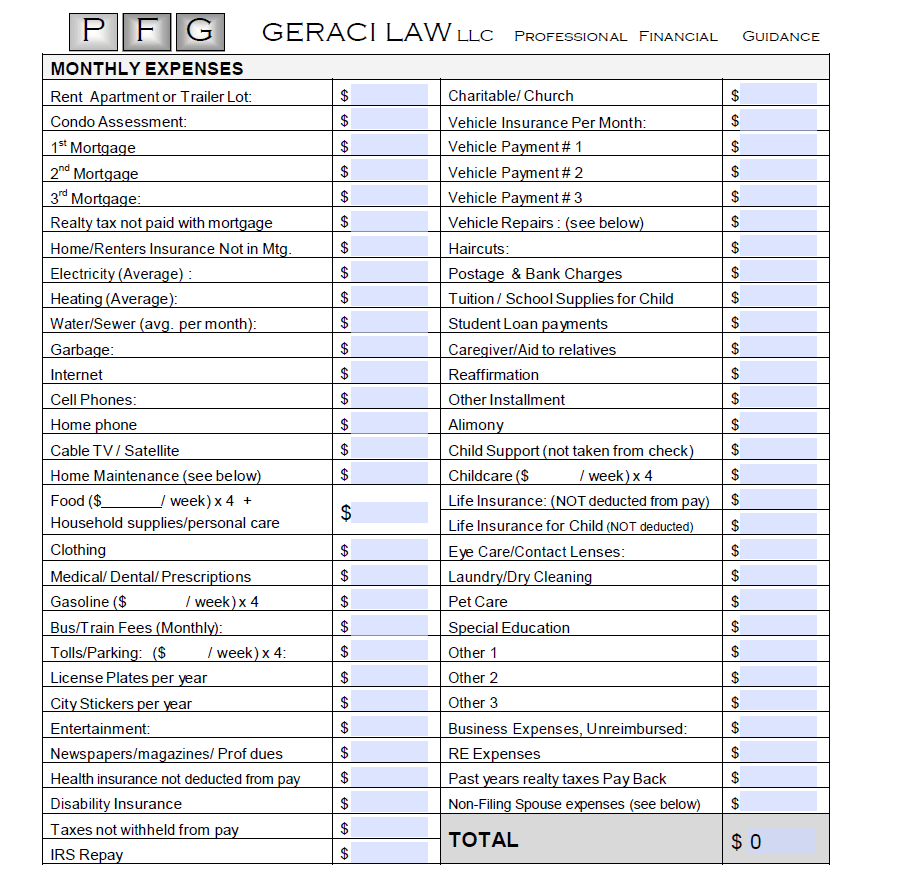

In order to reorganize your debt with Chapter 13, you have to have enough regular income in order to pay your regular business expenses, and then pay taxes on the profit, and then take home after taxes enough money to pay your regular living expenses, with at least $300 left over to devote to paying creditors. Very few self-employed businesses produce enough income to cover regular business expenses, let alone living expenses

Chapter 7 or Chapter 13 filing for individuals who are regularly employed is often a wonderful solution to the problem of too much data and not enough money. When a business is involved, the paperwork doubles or triples. You must answer questions under oath, about business financial affairs, and you’re not going to discharge payroll taxes if you haven’t paid them, or other employee obligations. In addition, a copy of your bankruptcy will go to the IRS, and you will be required to file your state local and federal tax returns before getting any bankruptcy relief.

We have seen many bad things happen to individuals who go to lawyers who are only too eager to take a couple files and can file a Chapter 7 or 11 for a business that is either still operating, or hasn’t been closed for more than two years. We’ve seen it turn into a real mess, and in some cases into federal indictments. We could go into a lot of examples, but if you are planning to file a business bankruptcy, we suggest that you don’t. Either tough it out, and hope that things get better, or close it and pay your taxes and file your returns. If you can’t pay the taxes, file returns anywhere, because you may be able to discharge income taxes if you file truthful returns come and see us in two or three years! Be very careful to pay your employee taxes and withholding because if you were supposed to turn over withheld funds to the government and you don’t, there is no statute of limitations about discharge.

There are a lot of small businesses that fail. Chances are good that 70% of small businesses will fail within three years. If that happens to your business, you should not file a bankruptcy immediately, if at all. You should

- wait until the businesses closes

- file all tax returns even if you can’t pay the taxes due

- keep your books and records because that is another requirement,

- return all property that is security for a loan, to those lender

- don’t do anything weird like transfer or hide assets, bankruptcy judges hate that

and then and only then come and see us about cleaning up the mess and getting a fresh start after the businesses closed. Be very careful if you don’t heed this advice and some attorney wants to file a bankruptcy when a business is still open, and you haven’t filed all tax returns. You could be paying a lot of money for nothing and even get into big trouble.

Dial 1-800-CALL-PFG for a free phone mini-consultation, or make an appointment online 24/7 at www.infotapes.com. Bankruptcy laws are in place to help you. Who knows bankruptcy like Geraci Law? Geraci Law has 30,000 5-star reviews  since November 2016!

since November 2016!

Read ALL ABOUT DEBT RELIEF at www.bankruptcybookbypeterfrancisgeraci.com.

![]() since November 2016!

since November 2016!