Come visit Attorney Christine Kuhlman in Westchester, Illinois for a free consultation regarding your debt relief options. We’re located at 927 S. Mannheim Rd. Westchester 60154. We’re just South of 290/Mannheim on the East side of Street, next to BP gas Station and across from Target/Holiday Inn Express.

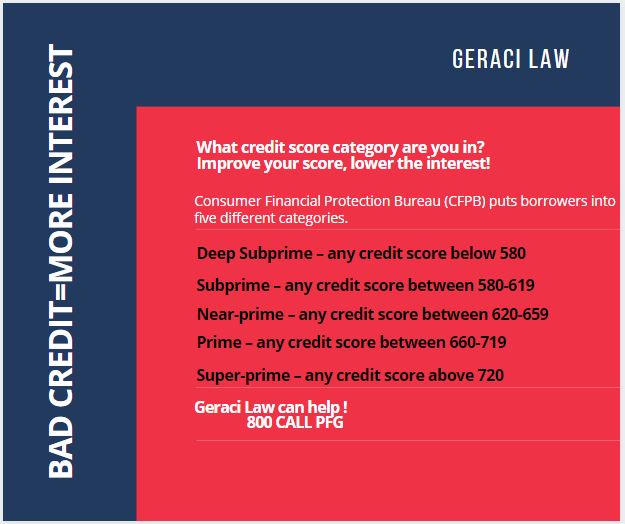

Attorney Christine Kuhlman is an attorney at Geraci Law. She has vast knowledge of Chapter 7 and Chapter 13 bankruptcies. She graduated with a Bachelor’s Degree in English from DePaul University and a Juris Doctor from John Marshall Law School.

Attorney Kuhlman is a member of the Illinois Bar Association, DuPage County Bar Association, and the DuPage Association of Women Lawyers. From the first consultation to bankruptcy discharge, clients should expect nothing but excellence from Attorney Kuhlman.

Dial 1-800-CALL-PFG for a free phone mini-consultation, or make an appointment online 24/7 at www.infotapes.com. Bankruptcy laws are in place to help you. Who knows bankruptcy like Geraci Law? Geraci Law has 30,000 5-star reviews ![]() since November 2016!

since November 2016!

Read ALL ABOUT DEBT RELIEF at www.bankruptcybookbypeterfrancisgeraci.com.